Tuesday, November 15, 2011

Occupy Yahoo

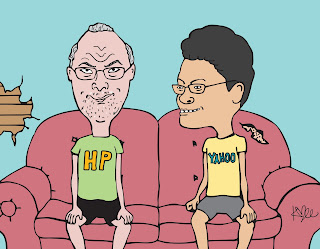

Cove Street Capital's latest strategy letter is now available on the firm's website. I highly recommend checking out the new piece to see portfolio manager Jeff Bronchick's comments on the corporate governance debacle that is Yahoo (YHOO). In addition, included with the posting is what has to be one of the most poignant and perfectly fitting pieces of artwork (also shown on the right had side of this page) you are going to see this year. I believe our in-house artist Kelli Manthei has captured the management acumen of Chief Yahoo Jerry Yang (note the incredible irony embedded in that title) and HP's former CEO Leo Apotheker amazingly well by portraying Yang as Beavis and Apotheker as Butt-Head. For those of you who might not be familiar with the famous characters created by Mike Judge, spending 5 minutes on YouTube should be enough to explain why no corporate CEO would ever want to be compared to these two cultural icons.

I hope you enjoy the piece and will continue to follow Cove Street's blog.

Sincerely,

The Inoculated Investor

Saturday, November 5, 2011

Earnings Per Share Myopia

Tuesday, October 25, 2011

The Inoculated Investor is Moving!

Tuesday, August 23, 2011

Exclusive Notes from a BB&T 1-on-1 Conference

(Disclaimer: The opinions included in the following posting belong to me and do not necessarily reflect those of Cove Street Capital “CSC” or any of its employees. The information in this posting should not be considered as a recommendation to buy or sell any particular security or to encourage anyone to invest with CSC. Past performance of CSC is not a guarantee or indicator of future results.)

Now that I am working on the buy-side on a full time basis again, I get to employ my note taking skills in variety of new mediums. Specifically, one of the perks of having relationships with sell-side firms is that it affords Cove Street Capital the opportunity to have its analysts meet with management teams from all over the country and world. In this case I had the opportunity to attend the recent BB&T 1-on-1 conference held in San Francisco. What I like about these types of conferences is the intimacy. In my former life on the buy-side I attended dozens of sell-side conferences in which 30 or 40 people packed into a small room to hear a pre-canned pitch by the management team of a specific company. While such conferences can be valuable and enlightening, I happen to believe that I learn a lot more when I have a chance to sit down in front of a CEO or CFO and ask targeted questions.

Not only does a 1-on-1 conference make me perform a significant amount of diligence on the companies I am scheduled to meet with, but it also allows me gain a granular knowledge that is often not accessible at less intimate affairs. So, kudos and a big thanks to BB&T for putting on a very well-run and informative conference at the Ritz-Carlton in downtown San Francisco.

On the day of the conference, I met with the management teams of eight different companies. Most of the meetings were 1-on-1’s but a couple were 2-on-1’s. Given that I only had a few days to prepare to meet with eight new (to me at least) companies, I was unable to perform the level of diligence I would have liked. However, in each case I had at least read the company’s most recent 10-K and 10-Q filings and had come up with a list of value-investor-oriented questions. The notes I took solely include my impressions of what was discussed and certainly do not represent the opinions of Cove Street or BB&T.

The list of companies and my notes are included in the Scribd document attached to this post and the Google Doc available here. However, I wanted to make some brief comments about each of the companies as a preview of what is included in the notes. You will notice that I have only posted the notes from seven of the firms as we are holding back on releasing the notes from one unnamed smart metering company that looks compelling on a secular trend and valuation basis.

Diamond Foods: A company in the midst of a very interesting and profound expansion after the acquisitions of Kettle Foods in 2010 and Pringles this year. Diamond is transforming itself from a low margin, nut-focused company to a higher margin, chip and popcorn producer.

CIBER: An IT consulting company in the midst of a turnaround after a change in management. The long struggling US operations are being centralized in an attempt to improve profitability and leverage the knowledge and skills transferred from the very successful European operations.

Perficient: Another IT consulting company that, unlike CIBER, is not focused on ERP implementation. Perficient is uniquely focused on continuing to grow in the US while maintaining its pristine (debt free) balance sheet.

Kansas City Southern: The smallest remaining independent Class 1 railroad company left in the US. KSU has some very interesting opportunities in Mexico and has what looks like a monopoly granted by the Mexican government. Also, read the notes for the CFO’s comments on Berkshire’s purchase of BNSF.

Tyson Foods: A meat protein company that is also very involved in prepared foods such as pizza crusts. The stock is trading at a low multiple because the chicken business has been hit by an oversupply of chickens and rising grain costs. However, the company thinks the chicken opportunity in China is huge (see KFC’s success in that country) and that the higher margin beef and pork businesses are being overlooked by investors.

Gorman-Rupp: A pump company that does nothing but keep its head down, execute, and make targeted acquisitions to help with growth. Accordingly, the company trades a much deserved premium. Gorman-Rupp is a Buffett-like company that investors should look to own at the bottom of an economic cycle when the market is sure the global economy will never recover.

Kirby Corp.: The largest marine transportation barge company in the US with about 28% market share. This size and scale allows the company to make money when the rest of the industry is struggling. Kirby strives to be one of the only rational players in an industry prone to overbuilding that causes utilization rates and prices to plunge.

As usual, if you have trouble with the Scribd document or the Google Doc, feel free to email me for a PDF copy of the notes. This site has been built through the posting of exclusive and unique content and even though my circumstances have changed a bit I hope to keep creating content that readers find valuable and informative. I hope you enjoy the notes!

Notes from BB&T 1-on-1 Conference

Thursday, July 28, 2011

2011 South Central Scholars Charity Idea Dinner

(Disclaimer: The opinions included in the following posting belong to me and do not necessarily reflect those of Cove Street Capital “CSC” or any of its employees. The information in this posting should not be considered as a recommendation to buy or sell any particular security or to encourage anyone to invest with CSC. Past performance of CSC is not a guarantee or indicator of future results.)

I recently had the distinct pleasure of co-hosting a charity idea dinner with my friend Alex Rubalcava of Rubalcava Capital Management. Alex is on the board of an incredible organization named South Central Scholars (SCS) and he asked me to help him plan the event. Right off the bat, I really liked the idea of participating in an event that involved two things that are quite important to me: investing and education. If you ask me what the one major threat to the continued prosperity of the United States is, my immediate response would surround my concern for the state of public education in America. As such, I gladly offered to help plan and promote an event that had the goal of raising money for underprivileged students and also provided an opportunity to talk about investing.

The format was simple: attendees were asked to contribute a charitable donation to SCS in exchange for a three course meal and exposure to the investment ideas of some of the brightest minds in Southern California.

The impressive list of presenters included:

- Ryan Morris of Meson Capital Partners who discussed First Marblehead (FMD)

- Matt Peterson of Peterson Capital Management who discussed option strategies on Coca Cola (KO) and Kraft (KFT)

- UCLA Anderson Professor Eric Sussman who discussed his top 16 accounting red flags

- My co-host Alex Rubalcava who discussed Clear Channel Outdoor (CCO)

- Toby Carlisle of Eyquem Fund Management and author of the popular blog Greenbackd who spoke about Xyratex (XRTX)

- Robert Wollendorf of Western Standard who discussed MI Developments (MIM)

- Brian Massey of Mar Vista Investments who spoke about First American Financial (FAF)

Also attending as an interested observer was Chuck Gillman of Boston Avenue Family Office. Finally, there were a number of people who were kind enough to donate but were unable to attend: John Schwartz (organizer of the Value Investing Congress), Lance Helfert of West Coast Asset Management (my former employer), Alan Schram of WellCap Partners, Dan Anglin of Prince Henry Group, and John Dash of Dash Acquisitions.

Most importantly, we were privileged to have the founders of SCS, Dr. Jim London and his wife Trisha, at the event. I personally found it motivating to see how two people who were inspired by a book (And Still We Rise by Miles Corwin) could turn a little idea into an impactful organization. Furthermore, I really enjoyed listening to Jose Rodriguez, a member of the SCS alumni community who shared real life anecdotes about the difference that SCS has made in his life. The value proposition of SCS becomes much more real and relevant when you meet someone who has directly benefitted from the work of the Londons and all of the other supporters of SCS.

Alex and I wanted to thank everyone for helping SCS achieve its goals. It was a wonderful night and I feel very fortunate to have had the chance to be involved with helping to raise money for such a great cause.

In addition, aside from acknowledging the generous participants of the event, the purpose of this post is to increase awareness of SCS. I know that many of the people who read this blog are not from California—or even from the US— and may not be particularly concerned about the plight of kids from South Central LA. Clearly, there are serious problems and deserving charities in every country around the world. As such, my hope in discussing the merits of SCS is not necessarily to entice people to contribute to this specific cause. If you think the value that SCS adds to the LA community is worthwhile, by all means I encourage you to become involved or help the organization raise money. But, for everyone else who would rather support causes a little closer to home, my hope is that the details of this event and description of SCS encourage you to look for ways to reach out to the educational community in your home state or country.

As mentioned above, SCS was founded by Dr. London and his wife after reading about the difficulties hard-working students from South Central LA were having escaping blighted neighborhoods and going to college. Accordingly, the goal of SCS is to help motivated high school students from inner city schools become successful in college and graduate school. These talented students are often from dysfunctional families and communities impacted by drugs and violence. Sadly, the high schools in such areas often only graduate 25% of their students and even those who do graduate may not have the financial means to attend college or are not aware of their options.

This is where SCS steps in to provide information, outreach and financial support to students from 39 high schools in the area. The main strategy is to try to get the strongest students to apply to private colleges, specifically the Ivy League schools and other small liberal arts colleges. The reason for this focus is that these schools are not only some of the top schools in the US, but they also provide the most generous financial packages; with some even guaranteeing that students will not graduate with any student loan debt. Once they are in college, SCS supports these students and their goals by:

- Putting on seminars that help students bridge any gaps between themselves and other college-ready students.

- Offering bridge scholarships that close void between the financial packages offered by the colleges and the actual total cost of the education.

- SCS supports approximately 300 currently enrolled college students

- Creating a mentoring program in which students are paired with people who have had success in careers that the students are interested in pursuing.

- Trying to help students work around obstacles such as financial, family, academic and psychological problems that may hinder them from succeeding in college.

- A number of students are also homeless and SCS works to find places for these young people to stay during holidays and summers.

- Helping students obtain valuable jobs and internships in fields that interest them.

It is hard to argue that giving these students the opportunity to go to college is not a worthy goal. In fact, the success of SCS makes the organization and ones like it look compelling destinations for charitable donations. But, anyone who approaches the world from an investor’s point of view likely wants to get the most bang for his or her buck. There are thousands of deserving charities out there. So, why is SCS any more deserving than the others? Well, given that I believe a failing educational system represents a real threat to this country’s long-term prosperity, what sold me on SCS was its ability to scale. When I asked the question about what prevented SCS from providing yearly bridge scholarships to 200 or 500 students instead of 74, the answer had nothing to do with personnel, staff or overhead. Simply, what prohibits SCS from expanding is funding. My understanding is that a large percentage of every dollar that SCS receives ends up supporting students as opposed to bloated infrastructures or administrative salaries. Further, after meeting a group of board members and founders whose only concern is helping underprivileged students, I became very comfortable making a donation.

Thus, if you share some of my concerns about the American educational system and want to donate or become involved, please visit SCS’s website at southcentralscholars.org. On that site you can find a place to make online donations and can learn more about volunteering opportunities or becoming an employer of these gifted students. I hope you will consider helping SCS expand its reach. If you have any questions or comments, please feel free to contact me or info@southcentralscholars.org.

Friday, July 8, 2011

Introduction to Cove Street Capital

(Disclaimer: The opinions included in the following posting belong to me and do not necessarily reflect those of Cove Street Capital “CSC” or any of its employees. The purpose of the post is to introduce the firm I will be working for as of July 1st, 2011. The information in this letter should not be considered as a recommendation to buy or sell any particular security or to encourage anyone to invest with CSC. Past performance of CSC is not a guarantee or indicator of future results.)

Dear Readers,

First, I wanted to thank everyone for the amazing response to my request for help in finding a full-time position in the investment management industry. I received emails from people from New York, Boston, and Chicago as well as Germany and Singapore (to name a few). I really appreciate the support and encouragement I received. What I have found is despite the fact that we are located all around the world, there is a cohesive group within the value investing community that is available to assist its members. I owe a special debt of gratitude to a gentleman in New York who enjoyed my notes from this year’s Markel Breakfast so much that he decided to recommend me to a friend of his, Jeff Bronchick.

Jeff Bronchick is the former CIO of a well-known asset manager in Los Angeles. After 22 years at the firm, Jeff left this firm to start up Cove Street Capital. For those of you interested in the name, Cove Street was the street that was home to Berkshire Hathaway’s original offices. However, unlike Berkshire, Cove Street has decided to locate its offices in El Segundo, CA, less than 2 miles from the Pacific Ocean. Thanks to a tip from the above-mentioned gentleman and my newly defined persuasion skills, I convinced Jeff to hire me to be one of two analysts that will help manage $400mm of assets for both institutions and high net worth individuals.

Jeff is a bottom-up value investor in the mold of Warren Buffett who runs a concentrated portfolio of stocks that he believes are trading below intrinsic value. He focuses on establishing a margin of safety in order to win by avoiding big losers. While Jeff pays attention to the macro environment and has written extensively about his top-down view of the world, he primarily relies on company fundamentals to make buy and sell decisions. Thanks to the wonderful Internet age we live in, Jeff’s strategy letters going back to the year 2000 are available at http://www.rcbinvest.com/resources/letters.html.

Accordingly, I was able to perform a good deal of due diligence on Jeff and subsequently became comfortable that we approached investing from the same point of view. For example, what impressed me the most was how clear it was that Jeff views the money management process as a fiduciary responsibility. As such, he refuses to become an asset gatherer or chaser of short-term performance. Instead, he is willing to invest with a multi-year outlook and is comfortable assuming the role of a contrarian, both of which are important to me.

I also have a soft spot for people who like to write and who are articulate, as I have made myself a very minor star in the value investing world through my writings. Similarly, Jeff wrote for TheStreet.com in the 1990s and for Grant’s Interest Rate Observer. It also doesn’t hurt that he is a Penn guy as well. Our relationship continues to build but my initial impression is that we have a lot in common, especially our passion for investing and love of security analysis. I have told everyone who has asked me about the position that this is a dream job for me and I am excited to start contributing.

I don’t think this is the place to talk much more about Cove Street’s strategies. That information is available on the firm’s website at http://www.covestreetcapital.com/Default.aspx. However, I do want to say that we will be looking for value and market inefficiencies in both small and large companies and will not shun international opportunities that arise. If you are interested in learning more about me, Jeff or any of the other team members, please visit the “About Us” tab on the website. Additionally, if you are an investor capable of making the Cove Street minimum investment and would like to inquire about investing with the firm, please contact Daniele Beasley at dbeasley@covestreetcapital.com.

Finally, we are still contemplating precisely what will become of The Inoculated Investor blog but I assure you that I am not done writing. I have far too much to say. Most likely, my thoughts on stocks and the markets in general will appear on Cove Street’s site while this site will continue to be dedicated to unique content (event notes, interviews, etc.) that I hope people will find compelling.

Thanks again for your support and for making running the blog an extremely positive experience. I hope that you will continue to follow my career on this site as well as on that of Cove Street.

Sincerely,

Ben Claremon

The Inoculated Investor

Cove Street Capital

Monday, July 4, 2011

Notes from the Final Conversation with Charlie Munger

Dear Readers,

Conversation With Charlie Munger

Wednesday, June 8, 2011

Notes from Creighton Value Investing Panel

Dear Readers,

Creighton Value Investing Panel

Wednesday, May 11, 2011

2011 Markel Breakfast Notes

- The state of the municipal bond market

- The state of the property and casualty insurance market

- Markel's approach to buying whole companies

- Inflation, hedging and currency risk

- The David Sokol affair

Markel Breakfast 2011 Notes

Sunday, May 8, 2011

Detailed Notes from the 2011 Value Investing Congress

Dear Readers,

- Guy Gottfried of Rational Investment Group pitched Morguard Corp (TSE: MRC), a Toronto-listed real estate company that is run by a great investor and whose stock looks to be trading a fraction of the value of its real estate properties. Not to take anything away from the other great speakers, but I think Guy made the best presentation.

- Ori Eyal of Emerging Value Capital Management discussed a share arbitrage opportunity with PRISA (NYSE: PRIS) A and B shares. His compelling analysis made it seem unlikely that an investor could lose money and very likely that there would be significant upside in the next 6 months.

*****Update: The Scribd document attached is the correct one. My apologies, for a little while last night (between 2am and 8am LA time) a not-complete version was available on Scribd. I am sorry if anyone downloaded a non-polished copy and would be happy to send you an updated PDF version if you email me.

2011 Value Investing Congress Notes

Monday, May 2, 2011

Comprehensive 2011 Berkshire Meeting Notes

2011 Berkshire Annual Meeting Notes

Sunday, April 24, 2011

Book Review: The Most Important Thing by Howard Marks

I was very fortunate to receive an advance copy of Howard Marks's new book, The Most Important Thing, directly from Howard himself. I then asked Howard if he would mind if I reviewed the book for my blog. Knowing how popular the memos he writes on behalf of Oaktree Capital Management are with members of the value investing community, I thought my readers would really enjoy learning more about his investment philosophy. Howard agreed to let me review the book on one condition: that I do so objectively and without hesitating from articulating any criticisms I had. The ultimate product is the following analysis of The Most Important Thing, in Scribd format because it is a little too long for a blog post. If you have any troubles with Scribd or would like a PDF copy, just email me at inoculatedinvestor@gmail.com and I will happily send it to you.

Book Review- The Most Important Thing by Howard Marks

Thursday, April 21, 2011

Stay Tuned for the Best Posts of the Year

Monday, March 28, 2011

Equity Research Piece: Sterling Construction Co. (STRL)

I came across Sterling Construction Co. (STRL) after running a screen on Capital IQ for companies with: low debt levels, market caps between $100M and $500M and trailing EV/EBITDA multiples below 7x. I happen to believe that there is a lot more inefficiency in the small cap space and thus I often dig in that arena. What I quickly saw was that companies reliant on government infrastructure spending were trading at very low EV/EBITDA multiples. In fact, during my research I also came across Orion Marine Group (ORN), a company that operates in similar markets to STRL. At first I was intrigued by the valuation of ORN, but after more digging, STRL became the more compelling research candidate.

Sterling Construction Co. Write Up

Monday, March 14, 2011

Please Help Japan

Readers,

- Please help the MBA programs at UCLA Anderson, Pepperdine, and USC support the disaster relief effort by making a donation at http://socalmbahelpjapan.wordpress.com/. All of the proceeds will be donated to the the US Red Cross. The acute crisis may be nearing an end (at least we all hope), but the devastation is ongoing and, as citizens of the world, we can't just forget about the people of Japan once the news cycle shifts to another topic.

- Keep informed about what is going on in Japan. Read newspapers, watch the news, keep up with your favorite blogs, follow Twitter. Do something to prevent yourself from moving on with your life just because the disaster didn't happen in your backyard. Because, especially if you live in California, one day it might happen here. The point is that the people of Japan deserve our empathy and for us to realize that we have an obligation to understand their plight.

- Finally, reach out to anyone you know who has roots in Japan. I am living vicariously through someone who is very close to me and is currently in Japan. I have to say it is so difficult that I can't imagine how hard it would be if my family, friends, and the place where I grew up were going through so much turmoil. Believe me, they need your support.

Santangel's Review Strikes Again!

Transcript of Warren Buffett Interview With FCIC

Wednesday, March 2, 2011

Lance Helfert on CNBC Last Friday

Monday, February 28, 2011

Introduction to Santangel's Review

Readers,

Thursday, February 17, 2011

Exclusive Notes from Howard Marks Presentation

Howard Marks Presentation to UCLA Student Investment Fund

Tuesday, February 8, 2011

My Second Article on MarketWatch

By Lance Helfert

SANTA BARBARA, Calif. (MarketWatch) — The U.S. economy is toast and prudent investors should stay away from U.S. stocks.

At least that is the belief espoused by a number of bearish market commentators who see the U.S. budget deficit, troubled housing market, and dependence on consumer spending as reasons that economic malaise will continue for years to come. And what if they are right? What does that mean for a stock market index such as the S&P 500 Index(SPX 1,325, +5.52, +0.42%) going forward? Perhaps not as much as one would think.

The reason is that many companies in the S&P 500 generate a substantial amount of revenue outside the U.S. According to Standard and Poor’s, of the 250 S&P 500 companies that report detailed information on foreign income, 47% of sales were generated outside the U.S. in 2009. This represents a 7% increase from 2006 with growth primarily coming from Asia. Accordingly, most investors have significantly more international exposure than they are aware of. In fact, the S&P 500 is positioned well to benefit from a major international secular trend that is likely to accelerate in the coming decade.

Specifically, the development that will drive spending growth across the world is improved living standards. Residents of the U.S. live in a modern country with seemingly endless amenities and access to a dizzying array of goods and services. As such, it is often easy to forget that developing nations do not necessarily have the same access to the goods that Americans take for granted.

However, as incomes rise and emerging economies become more advanced, citizens of these countries are going to demand the same standard of living enjoyed by their counterparts in developed nations. They will eat more meat, burn more fuel, buy more luxury goods, and desire the most advanced drugs and new technologies.

Populations of countries such as China and India dwarf that of the U.S. Even a small increase in the percentage of people who can afford more goods leads to a huge jump in the number of potential customers available to U.S. companies that have overseas operations.

For example, according to an October 2010 release from China’s Ministry of Security, the total number of automobiles in China is around 85 million. In contrast, according to the U.S.’s Bureau of Transportation Statistics, in 2008 there were approximately 137 million passenger cars in the U.S. This means that there are approximately 0.45 cars per person in the U.S and only 0.065 cars per person in China. If the ratio in China were to reach even one-third of the U.S. ratio, there would be nearly 200 million cars in China. Any material increase in this ratio for China would have a profound impact on energy consumption, global energy prices, and the global economy. Does anyone doubt that this ratio won’t increase?

None of this should come as a surprise to those who follow the global equity markets. Since the U.S. is expected to be stuck in a slow growth environment for a number of years, it is only logical that investors will continue to seek international exposure. But what is the best way to gain such exposure, and is the anticipated growth already reflected in foreign company valuations?

For the average investor, the answer to the first question is not to go directly to the source. While betting directly on emerging markets through their local stock exchanges may sound exciting, there are many risks that have to be taken into consideration. Such risks include lower liquidity and regulation, as well as higher volatility, currency risk, political risk, and risk of fraud. Second, many high-growth companies are already priced to perfection and assume that aggressive growth targets are met.

Despite the fact that the secular growth story in the emerging markets is so well known, many world class companies in the S&P 500 trade at cash flow multiples that do not reflect their significant exposure to these trends.

Take personal and health-care company Kimberly-Clark Corp. (KMB 65.01, -0.06, -0.09%)Aside from a slight blip in 2009, KMB has achieved consistent revenue and earnings growth since 2005. More importantly, revenue in Asia and Latin America increased more than 52%. KMB is an attractive company because of its exposure to international markets and the fact that its products are associated with a better quality of life. Irrespective of those positive aspects, KMB is currently trading at approximately nine times trailing cash flow with a dividend yield of 4.1%. Thus, KMB is precisely the type of company that should be enticing to investors looking for exposure to growth in developing markets.

Bears may be right and the U.S. economy may stagnate for the foreseeable future, but this concern should not cause investors to shy away from select U.S. companies with attractive valuations and international growth prospects.

Lance Helfert is president of West Coast Asset Management , and the co-author of “The Entrepreneurial Investor — The Art, Science and Business of Value Investing.” West Coast Asset Management does own Kimberly-Clark (KMB) in their portfolio. Ben Claremon contributed to this article.