Thursday, February 23, 2012

The Inoculated Investor’s Permanent New Home

Friday, February 3, 2012

Free Investment Conference at UCLA Anderson

Tuesday, November 15, 2011

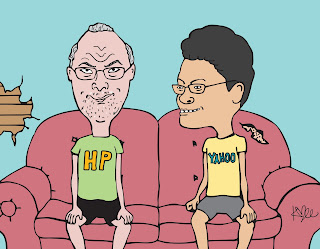

Occupy Yahoo

Cove Street Capital's latest strategy letter is now available on the firm's website. I highly recommend checking out the new piece to see portfolio manager Jeff Bronchick's comments on the corporate governance debacle that is Yahoo (YHOO). In addition, included with the posting is what has to be one of the most poignant and perfectly fitting pieces of artwork (also shown on the right had side of this page) you are going to see this year. I believe our in-house artist Kelli Manthei has captured the management acumen of Chief Yahoo Jerry Yang (note the incredible irony embedded in that title) and HP's former CEO Leo Apotheker amazingly well by portraying Yang as Beavis and Apotheker as Butt-Head. For those of you who might not be familiar with the famous characters created by Mike Judge, spending 5 minutes on YouTube should be enough to explain why no corporate CEO would ever want to be compared to these two cultural icons.

I hope you enjoy the piece and will continue to follow Cove Street's blog.

Sincerely,

The Inoculated Investor

Saturday, November 5, 2011

Earnings Per Share Myopia

Tuesday, October 25, 2011

The Inoculated Investor is Moving!

Tuesday, August 23, 2011

Exclusive Notes from a BB&T 1-on-1 Conference

(Disclaimer: The opinions included in the following posting belong to me and do not necessarily reflect those of Cove Street Capital “CSC” or any of its employees. The information in this posting should not be considered as a recommendation to buy or sell any particular security or to encourage anyone to invest with CSC. Past performance of CSC is not a guarantee or indicator of future results.)

Now that I am working on the buy-side on a full time basis again, I get to employ my note taking skills in variety of new mediums. Specifically, one of the perks of having relationships with sell-side firms is that it affords Cove Street Capital the opportunity to have its analysts meet with management teams from all over the country and world. In this case I had the opportunity to attend the recent BB&T 1-on-1 conference held in San Francisco. What I like about these types of conferences is the intimacy. In my former life on the buy-side I attended dozens of sell-side conferences in which 30 or 40 people packed into a small room to hear a pre-canned pitch by the management team of a specific company. While such conferences can be valuable and enlightening, I happen to believe that I learn a lot more when I have a chance to sit down in front of a CEO or CFO and ask targeted questions.

Not only does a 1-on-1 conference make me perform a significant amount of diligence on the companies I am scheduled to meet with, but it also allows me gain a granular knowledge that is often not accessible at less intimate affairs. So, kudos and a big thanks to BB&T for putting on a very well-run and informative conference at the Ritz-Carlton in downtown San Francisco.

On the day of the conference, I met with the management teams of eight different companies. Most of the meetings were 1-on-1’s but a couple were 2-on-1’s. Given that I only had a few days to prepare to meet with eight new (to me at least) companies, I was unable to perform the level of diligence I would have liked. However, in each case I had at least read the company’s most recent 10-K and 10-Q filings and had come up with a list of value-investor-oriented questions. The notes I took solely include my impressions of what was discussed and certainly do not represent the opinions of Cove Street or BB&T.

The list of companies and my notes are included in the Scribd document attached to this post and the Google Doc available here. However, I wanted to make some brief comments about each of the companies as a preview of what is included in the notes. You will notice that I have only posted the notes from seven of the firms as we are holding back on releasing the notes from one unnamed smart metering company that looks compelling on a secular trend and valuation basis.

Diamond Foods: A company in the midst of a very interesting and profound expansion after the acquisitions of Kettle Foods in 2010 and Pringles this year. Diamond is transforming itself from a low margin, nut-focused company to a higher margin, chip and popcorn producer.

CIBER: An IT consulting company in the midst of a turnaround after a change in management. The long struggling US operations are being centralized in an attempt to improve profitability and leverage the knowledge and skills transferred from the very successful European operations.

Perficient: Another IT consulting company that, unlike CIBER, is not focused on ERP implementation. Perficient is uniquely focused on continuing to grow in the US while maintaining its pristine (debt free) balance sheet.

Kansas City Southern: The smallest remaining independent Class 1 railroad company left in the US. KSU has some very interesting opportunities in Mexico and has what looks like a monopoly granted by the Mexican government. Also, read the notes for the CFO’s comments on Berkshire’s purchase of BNSF.

Tyson Foods: A meat protein company that is also very involved in prepared foods such as pizza crusts. The stock is trading at a low multiple because the chicken business has been hit by an oversupply of chickens and rising grain costs. However, the company thinks the chicken opportunity in China is huge (see KFC’s success in that country) and that the higher margin beef and pork businesses are being overlooked by investors.

Gorman-Rupp: A pump company that does nothing but keep its head down, execute, and make targeted acquisitions to help with growth. Accordingly, the company trades a much deserved premium. Gorman-Rupp is a Buffett-like company that investors should look to own at the bottom of an economic cycle when the market is sure the global economy will never recover.

Kirby Corp.: The largest marine transportation barge company in the US with about 28% market share. This size and scale allows the company to make money when the rest of the industry is struggling. Kirby strives to be one of the only rational players in an industry prone to overbuilding that causes utilization rates and prices to plunge.

As usual, if you have trouble with the Scribd document or the Google Doc, feel free to email me for a PDF copy of the notes. This site has been built through the posting of exclusive and unique content and even though my circumstances have changed a bit I hope to keep creating content that readers find valuable and informative. I hope you enjoy the notes!

Notes from BB&T 1-on-1 Conference

Thursday, July 28, 2011

2011 South Central Scholars Charity Idea Dinner

(Disclaimer: The opinions included in the following posting belong to me and do not necessarily reflect those of Cove Street Capital “CSC” or any of its employees. The information in this posting should not be considered as a recommendation to buy or sell any particular security or to encourage anyone to invest with CSC. Past performance of CSC is not a guarantee or indicator of future results.)

I recently had the distinct pleasure of co-hosting a charity idea dinner with my friend Alex Rubalcava of Rubalcava Capital Management. Alex is on the board of an incredible organization named South Central Scholars (SCS) and he asked me to help him plan the event. Right off the bat, I really liked the idea of participating in an event that involved two things that are quite important to me: investing and education. If you ask me what the one major threat to the continued prosperity of the United States is, my immediate response would surround my concern for the state of public education in America. As such, I gladly offered to help plan and promote an event that had the goal of raising money for underprivileged students and also provided an opportunity to talk about investing.

The format was simple: attendees were asked to contribute a charitable donation to SCS in exchange for a three course meal and exposure to the investment ideas of some of the brightest minds in Southern California.

The impressive list of presenters included:

- Ryan Morris of Meson Capital Partners who discussed First Marblehead (FMD)

- Matt Peterson of Peterson Capital Management who discussed option strategies on Coca Cola (KO) and Kraft (KFT)

- UCLA Anderson Professor Eric Sussman who discussed his top 16 accounting red flags

- My co-host Alex Rubalcava who discussed Clear Channel Outdoor (CCO)

- Toby Carlisle of Eyquem Fund Management and author of the popular blog Greenbackd who spoke about Xyratex (XRTX)

- Robert Wollendorf of Western Standard who discussed MI Developments (MIM)

- Brian Massey of Mar Vista Investments who spoke about First American Financial (FAF)

Also attending as an interested observer was Chuck Gillman of Boston Avenue Family Office. Finally, there were a number of people who were kind enough to donate but were unable to attend: John Schwartz (organizer of the Value Investing Congress), Lance Helfert of West Coast Asset Management (my former employer), Alan Schram of WellCap Partners, Dan Anglin of Prince Henry Group, and John Dash of Dash Acquisitions.

Most importantly, we were privileged to have the founders of SCS, Dr. Jim London and his wife Trisha, at the event. I personally found it motivating to see how two people who were inspired by a book (And Still We Rise by Miles Corwin) could turn a little idea into an impactful organization. Furthermore, I really enjoyed listening to Jose Rodriguez, a member of the SCS alumni community who shared real life anecdotes about the difference that SCS has made in his life. The value proposition of SCS becomes much more real and relevant when you meet someone who has directly benefitted from the work of the Londons and all of the other supporters of SCS.

Alex and I wanted to thank everyone for helping SCS achieve its goals. It was a wonderful night and I feel very fortunate to have had the chance to be involved with helping to raise money for such a great cause.

In addition, aside from acknowledging the generous participants of the event, the purpose of this post is to increase awareness of SCS. I know that many of the people who read this blog are not from California—or even from the US— and may not be particularly concerned about the plight of kids from South Central LA. Clearly, there are serious problems and deserving charities in every country around the world. As such, my hope in discussing the merits of SCS is not necessarily to entice people to contribute to this specific cause. If you think the value that SCS adds to the LA community is worthwhile, by all means I encourage you to become involved or help the organization raise money. But, for everyone else who would rather support causes a little closer to home, my hope is that the details of this event and description of SCS encourage you to look for ways to reach out to the educational community in your home state or country.

As mentioned above, SCS was founded by Dr. London and his wife after reading about the difficulties hard-working students from South Central LA were having escaping blighted neighborhoods and going to college. Accordingly, the goal of SCS is to help motivated high school students from inner city schools become successful in college and graduate school. These talented students are often from dysfunctional families and communities impacted by drugs and violence. Sadly, the high schools in such areas often only graduate 25% of their students and even those who do graduate may not have the financial means to attend college or are not aware of their options.

This is where SCS steps in to provide information, outreach and financial support to students from 39 high schools in the area. The main strategy is to try to get the strongest students to apply to private colleges, specifically the Ivy League schools and other small liberal arts colleges. The reason for this focus is that these schools are not only some of the top schools in the US, but they also provide the most generous financial packages; with some even guaranteeing that students will not graduate with any student loan debt. Once they are in college, SCS supports these students and their goals by:

- Putting on seminars that help students bridge any gaps between themselves and other college-ready students.

- Offering bridge scholarships that close void between the financial packages offered by the colleges and the actual total cost of the education.

- SCS supports approximately 300 currently enrolled college students

- Creating a mentoring program in which students are paired with people who have had success in careers that the students are interested in pursuing.

- Trying to help students work around obstacles such as financial, family, academic and psychological problems that may hinder them from succeeding in college.

- A number of students are also homeless and SCS works to find places for these young people to stay during holidays and summers.

- Helping students obtain valuable jobs and internships in fields that interest them.

It is hard to argue that giving these students the opportunity to go to college is not a worthy goal. In fact, the success of SCS makes the organization and ones like it look compelling destinations for charitable donations. But, anyone who approaches the world from an investor’s point of view likely wants to get the most bang for his or her buck. There are thousands of deserving charities out there. So, why is SCS any more deserving than the others? Well, given that I believe a failing educational system represents a real threat to this country’s long-term prosperity, what sold me on SCS was its ability to scale. When I asked the question about what prevented SCS from providing yearly bridge scholarships to 200 or 500 students instead of 74, the answer had nothing to do with personnel, staff or overhead. Simply, what prohibits SCS from expanding is funding. My understanding is that a large percentage of every dollar that SCS receives ends up supporting students as opposed to bloated infrastructures or administrative salaries. Further, after meeting a group of board members and founders whose only concern is helping underprivileged students, I became very comfortable making a donation.

Thus, if you share some of my concerns about the American educational system and want to donate or become involved, please visit SCS’s website at southcentralscholars.org. On that site you can find a place to make online donations and can learn more about volunteering opportunities or becoming an employer of these gifted students. I hope you will consider helping SCS expand its reach. If you have any questions or comments, please feel free to contact me or info@southcentralscholars.org.